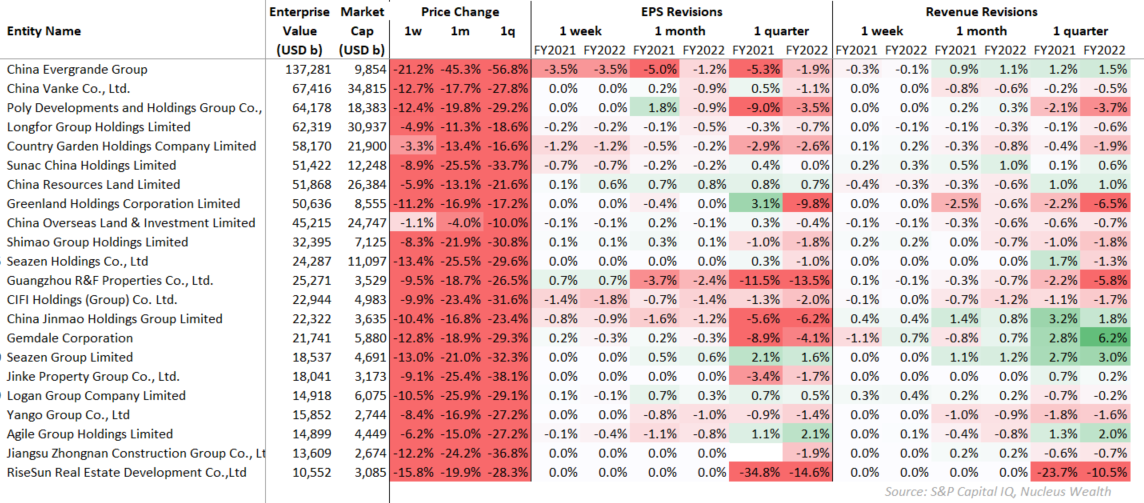

How will this affect property developers? The government is seeking to inhibit property developers’ ability to expand and fund operations with debt, but this is unlikely to resolve the causes of the property sector’s financial woes. In fact, in 2020, Evergrande Group 恒大集团, China’s largest investment holding company, was not only the world’s largest real estate developer in terms of assets, but also the sixth-most indebted company in the world with a debt of $100 billion.īy imposing conservative financial expectations with its “three red lines” policy, Beijing acted proactively to stabilize the deteriorating financial health and growth debts of domestic property developers in order to preempt a financial crisis. Debt itself is not to be feared in this industry, but the question that Beijing’s “three red lines” policy seeks to answer is how much liability is acceptable before a company is not able to service its debts and fails to meet its obligations to creditors, investors, and home buyers.Īt the time of the policy’s introduction in August 2020, 109 of 224 domestic real estate bond issuers possessed above average growth rates of interest-bearing debt, which means that nearly half of these issuers were at financial risk as a result of highly leveraged portfolios. Thus, high D/E ratios can be beneficial as leverage can significantly affect equity returns. The average D/E ratio of real estate developers is approximately 352%, as they make use of high leverage for large buyout transactions. How much liability is acceptable?Īverage debt-to-equity (D/E) ratios vary in each industry, and high debt is not unusual in the real estate sector. The overall objective is to reduce leverage, increase liquidity, and mitigate financial risks associated with heavy debt refinancing strategies. The government required that all three real estate developers in attendance at the symposium attain the debt reduction targets by June 30, 2023. Red indicates that all lines have been crossed, and the liability growth rate cannot increase at all.Orange indicates that two lines have been crossed, and the liability growth rate cannot exceed 5%.Yellow indicates that one line has been crossed, and the liability growth rate cannot exceed 10%.Green indicates that a company meets all three requirements of the “three red lines”, and the liability growth rate cannot exceed 15%.Each overstepped line is accompanied by annual growth restrictions on interest-bearing liabilities: The policy categorizes real estate developers by means of four colors, with each color corresponding to the number of “red lines” that are overstepped. Cash to short-term borrowings ratio must be less than 1.Net debt to equity ratio must be less than 100%.Asset to liability ratio must be greater than 70%.It earlier managed to raise around $144 million by slashing its stake in an internet company, with stock exchange filings showing it sold a 5.7 percent stake in HengTen Networks Group in three separate transactions.Įvergrande is among a number of Chinese developers caught in a crackdown on speculation and leverage in the country's colossal property sector, working to rein in excessive debt.īut authorities appear now to be rolling back some of these regulations, with the Securities Times reporting Wednesday that bank lending has been relaxing to make it easier for property companies to raise cash. In October, the company swerved more looming defaults by making overdue interest payments to offshore bond-holders.īogged down in liabilities worth more than $300 billion, the Shenzhen-headquartered developer has been trying to dispose of its assets to raise cash. Two investors holding two of the bonds confirmed that they received the payments, Bloomberg added.Ĭlearstream did not immediately respond to AFP's request for comment. The 30-day grace periods for the latest interest payments were to end on Wednesday, but customers of international clearing firm Clearstream reportedly received their payments, Bloomberg News reported. The liquidity crunch at one of China's biggest property developers has battered investor sentiment and rattled the country's key real estate market, adding to fears of wider contagion. Evergrande was up 8.4 percent in Hong Kong morning trade.Īll eyes had been on the heavily indebted company as it faced a Wednesday deadline for $148 million in coupon payments - after missing the initial due dates last month.

0 kommentar(er)

0 kommentar(er)